Marketing attribution is a key tool in every marketers’ tool kit, working to help marketers answer a critical question: “What is the true impact of our marketing spend when it comes to driving growth?” More and more marketers are recognizing the incredible value that attribution solutions bring to an organization, and the market is becoming increasingly crowded. In fact, the global marketing attribution space is growing at a Compound Annual Growth Rate (CAGR) of 14.4%, reaching $3.6 billion by 2023.

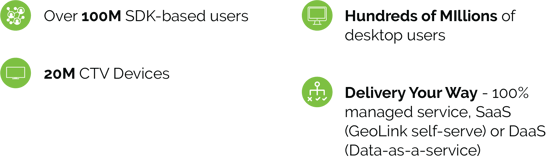

At InMarket, we’re incredibly proud of our industry-leading omnichannel solution that supports the needs of marketers from a single provider, from planning to purchase. Success today requires marketers to learn more about their prospects and customers, to build hyper relevant omnichannel marketing programs, and then to measure and optimize to grow. InMarket’s attribution solution, Lift Conversion Index® (LCI) was designed to do just that. We could go on and on about our unmatched data scale (80% of US smartphones and more than 560M anonymized credit cards), our new 360-degree Sales Lift reporting, or our real-time campaign optimization engine—and we certainly can if you’re interested!

But good news. You don’t have to take our word for it.

InMarket recently commissioned Forrester Consulting to examine the potential ROI an organization may realize by deploying LCI®. The study, The Total Economic Impact™ Of InMarket Lift Conversion Index® Attribution Solution, was published in July and details the benefits and cost savings that brands can realize when they implement LCI®.

As part of the TEI process, Forrester interviewed four InMarket clients anonymously. Their testimony is pretty compelling:

ACCURACY (AND PRECISION)

“We have done our own analysis in the past to show the accuracy of the LCI data, so we know it’s accurate to a degree we’re confident with. The results are believable and that’s what keeps us going back to InMarket.”

— Director of communications planning

OMNICHANNEL

“The reason why I ended up choosing InMarket was because my goal was to measure everything that we do to foot traffic. Not just the digital geofencing, but also out-of-home, radio, and television.”

— VP of marketing, quick service restaurant

OPTIMIZATION

“We run most of our campaigns with LCI and see the results are getting better and better as we optimize over time. With LCI, we can optimize spending to drive people into stores even outside of our big sales for the year. We have seen a 25% increase in net sales that were written outside of the holidays.”

— SVP and head of decision science, department store

What’s more, the Forrester TEI study found that an organization running 1 billion impressions per quarter could realize the following benefits when deploying LCI®:

- An average increase of $40 in ROAS related to incremental store visits from optimizing with LCI®

- Improved repeat store visits by 25%

- Improved media mix and channel optimization efforts saving $1.8M annually

- 1,800 internal person hours saved annually

- An overall benefit adding up to a Net Present Value (NPV) of $11.16M over 3 years, generating a 180% overall ROI

- Plus several additional unquantified benefits, including an improved understanding of media value, channel experimentation and improved efficiency, adaptation, and resilience in times of intense change.

To understand the full breadth of benefits and cost savings associated with InMarket LCI®, download the study now. Plus, be sure to attend our webinar on September 15th at 2pm EST where we’ll be joined by Forrester Consultant Nick Mayberry to discuss the study’s results.

Finally, to hear what customers of LCI® have to say, check out our award-winning Lift Leaders, whose use of attribution have driven their organizations to great heights and growth.

.png?width=250&name=Holiday%20Party%20Enthusiasts%20(1).png)

goal has always been to provide the most accurate, responsive, and scalable strategies to help you grow. This is why we have consistently delivered new, innovative and exclusive solutions that help you reach and exceed aggressive KPIs.

goal has always been to provide the most accurate, responsive, and scalable strategies to help you grow. This is why we have consistently delivered new, innovative and exclusive solutions that help you reach and exceed aggressive KPIs.