In this updated report on Vegetarian-Leaning Consumers, as more consumers increasingly demand healthier alternatives, it’s clear that consumer preferences are evolving quickly with the announcement of Beyond Meat’s IPO and Burger King rolling out Impossible Whoppersnationwide. By analyzing real-time foot traffic patterns from millions of opted-in U.S. consumers, we are able to gain a granular and actionable perspective on changing grocery and QSR/fast casual trends, and guide marketers to connect with relevant audiences as trends shift.

Get the full results for this deep-dive report on Where Vegetarian-Leaning Consumers Grub & Grocery Shop — now available here.

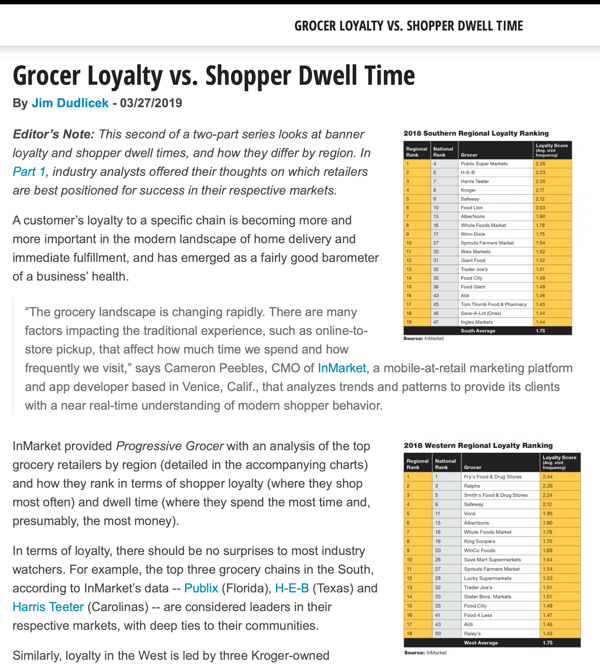

Specialty Grocers Outpace Mainstream Grocers

Specialty grocers like Whole Foods, Trader Joe’s, and Sprouts have outpaced mainstream grocers, likely due to the fact that they offer a much more diverse array of vegetarian options than their mainstream counterparts as demand for meat alternatives increases. These specialty grocers also have historically focused on specialty food items like alternative healthier food items and vegetarian offerings — which makes the top 3 grocery chains appealing to vegetarian-leaning shoppers.

Traditional Grocers Included in Majority of Top Choices

While the top 3 are made up of specialty grocers, a majority of the top 10 also include more traditional grocery chains. While vegetarian-leaning consumers over-index at specialty grocers, mainstream grocers are still appealing to this audience as they have expanded their vegetarian options to stay competitive — the convenience of being able to buy specialty items without taking an extra trip to a specialty grocer is an attractive selling point to consumers.

Top Choices of QSRs/Fast Casual Eateries Test Meatless Options

Little Caesar’s, which sits at #8 on the list, is currently testing the Impossible Supreme pizza which features the animal protein substitute from Impossible Foods, further cementing the trend towards meatless options. Also included are fast food Mexican joints, which is also makes sense considering Del Taco recently released their new meatless menu item, Beyond Tacos.

Pizza Rules Other Food Categories

3 of the top 5 restaurants that meat alternative buyers go to are pizza joints. Pizza chains are most popular among customers who purchase meat alternative products, likely because a plain cheese pizza or a veggie supreme is, of course, vegetarian. MOD Pizza, one of the highest ranking fast casual eateries for vegetarian-leaning customers, also happens to be one of the most-funded, having raised more than $312 million thus far.

Sandwich & Mexican Joints Would Benefit from Introducing Meatless Alternative Items

Interestingly, we have three major sandwich chains and two Mexican food chains that over- index with vegetarian-leaning customers, which makes both categories a likely place for expansion of Impossible products.

How We Did It

inMarket used first-party, SDK-derived location data of over 50 million Comscore-verified active users to first identify vegetarian-leaning consumers based on which meat alternative brands they’ve purchased, then analyzed their visitation patterns to rank the grocers and eateries this group over-indexes.

So What? Why Should I Care?

Next to using a crystal ball, observing foot traffic patterns is one of the best predictors for consumer behavior, grocery, and fast food chain strategy. Measuring these real-time movements is crucial because it provides an extra dimension of observation and early visibility into how new menu offerings might affect the direction in which the QSR/fast casual industry will move.

Get the full results for this deep-dive report on Where Vegetarian-Leaning Consumers Grub & Grocery Shop — now available here.

Want more inSights reports? Sign up at go.inmarket.com/subscribe or check out inmarket.com/insights.

To learn how your brand can connect with consumers on key milestone days, contact us today.

want a wider variety of healthier options. Burger King is

want a wider variety of healthier options. Burger King is